In today’s increasingly complex financial landscape, affluent individuals and families need more than occasional advice—they need trusted oversight, proactive support, and seamless coordination. At Santa Barbara Fiduciary, our financial concierge services are designed to simplify your financial life while supporting your long-term goals. From streamlining day-to-day transactions to supporting strategic planning and collaboration with your…

Our Blog

High-net-worth individuals often seek effective strategies to manage and preserve their estates. One powerful tool is the Irrevocable Life Insurance Trust (ILIT). Understanding how ILITs work and their benefits can significantly enhance estate planning efforts. How Does an ILIT Work? An ILIT is designed to own and control a life insurance policy, thereby removing the…

If you wish your charitable giving made a bigger dent on your income taxes, you’re not alone. Since the Tax Cuts and Jobs Act (TCJA) went into effect in 2018, many individuals are finding that their charitable donations just aren’t making the same impact they used to. That’s because the TCJA made sweeping changes that…

As an experienced fiduciary, we understand that your estate plan is not just about finances; it’s about safeguarding your legacy and ensuring your loved ones are provided for according to your wishes. Critical to this process are precise asset titling, strategic beneficiary designations, and the proactive appointment of successor agents. Let’s explore these elements with…

Minimize estate taxes & maximize your lifetime exemption with strategic gifting! Learn how annual gift tax exclusions & the current tax law can benefit your estate plan, and act now as major tax changes loom.

As the familiar deadline of April 15th approaches, many of us find ourselves buried under a mountain of government-issued tax paperwork. Amidst the chaos, it’s easy to lose sight of the bigger picture: understanding the documents you’ve received, and how they can help you prepare for the future.

empower-your-legacy

empower-your-legacy

Estate planning can be a complex and sensitive matter, and we often look to celebrities for lessons in what not to do. The unfortunate tales of celebrities like Aretha Franklin and Prince—and the subsequent family dramas—serve as cautionary tales for everyone. At Santa Barbara Fiduciary, we understand that it’s crucial to navigate trust administration with…

Creating an estate plan is a vital step in securing your financial future and protecting your loved ones. However, it’s not enough to simply have a plan. To ensure its efficacy and gain true peace of mind, you must understand what each document aims to achieve. Below, we’ll explore the must-have documents that every estate…

June is Alzheimer’s & Brain Awareness Month, a time to raise awareness about Alzheimer’s disease and the impact it can have on individuals and their families. As Alzheimer’s progresses, managing finances can become increasingly challenging—in fact, some of the earliest warning signs of dementia include money mismanagement. Recognizing these signs—and taking proactive steps to protect…

If you haven’t watched HBO’s series “Succession” yet, it revolves around a family that owns a media conglomerate. The show delves into the power struggles among family members as they vie for control of the family business while also grappling with their patriarch’s failing health. These themes resonate with the everyday challenges we’ve seen at…

The world of money management is a jungle, so it only makes sense that you would build an ecosystem of advisors to ensure your financial and investment planning stays on track. A professional fiduciary is a key player in this arrangement and can support you in everything from day-to-day money management to acting as your…

As our loved ones age, it’s important that they have a thoughtful plan in place for both care and finances, before they develop dementia or otherwise become incapacitated. In California, complete estate plans include an Advanced Health Care Directive (AHCD) and durable power of attorney (POA). While immediate health care decisions are typically delegated to…

Meet Barbara Liss, The Artist Some of you know as her as our esteemed colleague, many of you know her as a beloved part of the Santa Barbara estate planning community, and now we would like to introduce her to you as an artist. As Barbara advances toward complete retirement from the fiduciary services field…

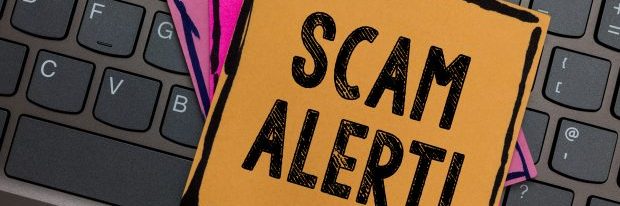

Elderly Americans are too often the targets of financial scams. Although people of any age may become victims of fraud, scammers often specifically target seniors because they are frequently more trusting and may not be as cognitively aware as younger people. Whether the fraudsters enact their schemes via phone, email, or in person, it’s important…

As we head deeper into 2023, now is the time to reflect on the past year, and to set aspirations for the year ahead. This time around, however, instead of making the same old weight loss, exercise, or eating healthy resolutions, focus on a resolution committed to safeguarding your personal and financial affairs. This year,…

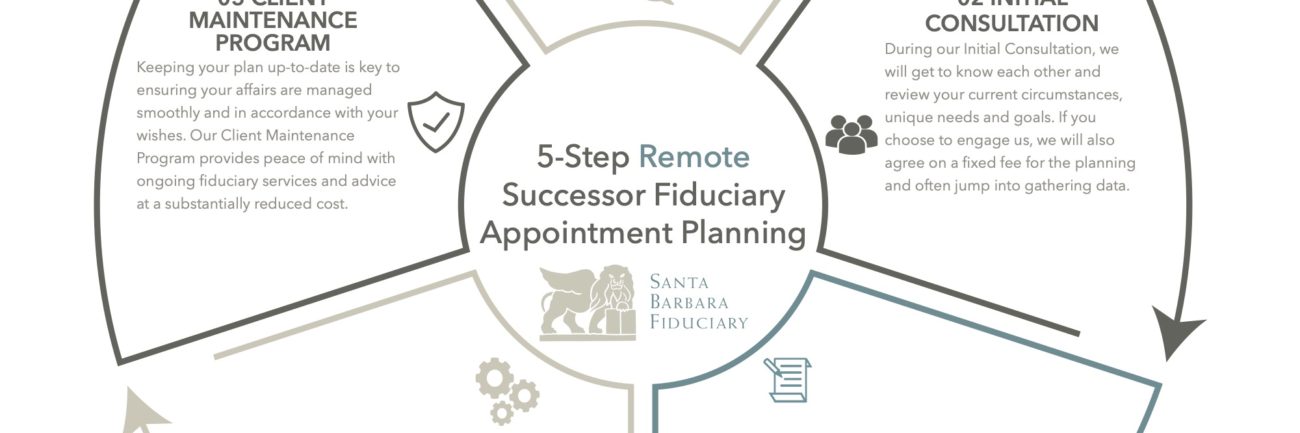

If you have a trust, you need to prepare for all possibilities—this means naming a successor trustee who would take over the management of the trust if the original trustee were to become incapable, whether due to death, incapacity, or any other reason. Choosing a successor trustee is a difficult decision for many people. However,…

It’s officially November, which means—like it or not—the holiday season has begun. Garland will soon dress every storefront, ornaments are already being hung, and every shopping mall in America has hit ‘play’ on an endless list of catchy carols to carry you through the season. For many, it’s the most wonderful time of the year.…

Until recently, Anne Heche was an Emmy award-winning actress best known for her roles in such blockbusters as Donnie Brasco and I Know What You Did Last Summer. However, after a tragic car accident took her life in August 2022, it’s her estate that has made its way into the headlines. The biggest estate planning…

Choosing the right person to manage your affairs when you die or if you become incapacitated isn’t easy. It can be even more challenging if you aren’t married and don’t have appropriate family members available to step in. Your parents, children or siblings may either not be available, or not the right fit. Or maybe…

A Professional Fiduciary is an individual who is entrusted property or power for the benefit of another.

A professional fiduciary can save you the time and stress spent looking for records and summarizing tax data.

The term, “fiduciary,” may sound dry and academic, but its significance is profound. This article revisits what a fiduciary is, and affirms why family members, trusted advisors, and others who oversee vulnerable or compromised populations should embrace professional fiduciaries.

One of the most important decisions you make in the estate-planning process is the selection of fiduciaries who will represent you when you no longer can act for yourself. Here are four reasons to consider using a Professional Fiduciary in your estate planning.

This complimentary newsletter is an educational resource with “links” on financial exploitation & behavior that may contribute to privacy concerns/financial exploitation. DISCLAIMER: Information & links are based on sites that appear to me as legitimate, but even I can be duped. If you find a problem, please let me know immediately, so that I can get the word out. Judy Christman Yates, DPA,Criminologist,

Collaboration among the client, drafting attorney, and a professional fiduciary during the drafting phase of the estate planning can provide for a more streamlined estate plan on-boarding process and estate administration.

Heeding the Call: The Story of California Professional Fiduciaries is a 15 minute video, produced in 2020, intended to describe how the profession started and how California fiduciaries work with clients, families, attorneys and the courts.

People often come to my office, recognizing the terms “trust” and “will,” but without a clear understanding of their differences. Learning more about these documents – and how they differ and how they can complement each other – will help you build a better estate plan for you and your family.

When you visit your financial advisor, you trust their competency and ability to maintain and grow your hard-earned money. You rely on these investments to provide for your retirement, and every dollar counts when planning to live on a fixed income. But what if your financial advisor does not disclose that they collect a higher fee based on an annuity account you may not benefit most from? How do you know if annuities are a right fit for your portfolio? Here are the dirty secrets about annuities.

A Revocable Living Trust is a great estate planning tool that offers some equally great benefits, but like a traditional Will, sometimes changes need to be made. For this, you have two options: an amendment or a restatement. Here’s how to know which one to use. A Trust Amendment is just what it sounds like…

Are Your Digital Assets Protected? Don’t Overlook This Important Piece of Your Estate Planning Puzzle The concept of estate planning has always been pretty straightforward: by “planning” in advance, you can ensure your assets are protected should you become incapacitated, and later distributed in accordance with your wishes after you’re gone. Of course, the…

This complimentary newsletter is an educational resource with “links” on financial exploitation and behavior that may contribute to privacy concerns/financial exploitation. CREDIT/SOURCE: Judy Christman Yates, DPA, Criminologist

6 Steps to Ensure Your Estate Plan’s Success Estate planning is about getting plans in place to manage risks at the end of your life and beyond. No one wants to spend more time than necessary contemplating their mortality. But putting in the work now will save your loved ones from months or…

Your will, trust and POA aren’t the only things you need in your estate plan. Here’s what you need to know about advance healthcare directives.

3 Things You Should Know About Being A Trustee If you’ve been designated as the Trustee in an estate plan, you might be wondering what comes next. And if you’re not, you should be. Because being a Trustee is serious business. In very basic terms, you have been appointed to administer a trust…

In case you haven’t heard… now is a great time to ensure you have an up-to-date plan in place to manage risks and ensure your wishes are honored if you become unavailable for any reason. Does your estate plan identify the people in your life that you trust have the skills, availability, objectivity and fortitude…

So you’ve finally gotten through the initial step of creating and executing your estate planning documents. Now you’re wondering where should you store the originals. The answer is really simple—in a safe and accessible place. But what does that mean exactly? This article provides tips and insights to help make sure that all the work you’ve put in to creating a thoughtful and meaningful estate plan serves you, by ensuring that your documents are safe, accessible and available to your successor agent(s) when they need them.

Contact us today to set-up a complimentary remote Initial Consultation!

Today’s COVID-19 pandemic is a reminder that everyone is vulnerable to disease, uncertainty and loss.

Please know that your safety and peace of mind is our priority. We’re here to support you in any way we can.

Lindsay Leonard, a California licensed private professional fiduciary, has continuously offered her services to the public for the last 10 years. In that time, she encountered many situations where families struggled with their own internal dynamics during periods of rapid, cumulative changes. Those shifting components led her clients to seek outside assistance, which eventually brought them to…

Check out our Feature in this week’s edition of the Montecito Journal!

February 13 – 20, Vol 26 Issue 7 [Village Beat]

“UCSB grad Lindsay Leonard thanks grandmother for 11 years of success at helm of Santa Barbara Fiduciary, p. 32”

Download/Print Article Here Lindsay Leonard, a California licensed private professional fiduciary, has continuously offered her services to the public for the last 10 years. In that time, she encountered many scenarios where families struggled with their own internal dynamics during periods of rapid, cumulative changes. Those shifting components led her clients to seek outside…

How a Private Professional Fiduciary Can Help Today Perhaps you’re astute enough to recognize the term “Private Professional Fiduciary” and already know that this is a wise alternative solution to naming family members as successor trustees in estate planning for a variety of smart reasons. Because those we love are often busy with their own…

Santa Barbara, CA (Santa Barbara Lawyer Magazine) December 2018 — Private Professional Fiduciaries as Revocable Living Trust Successor Trustees Frequently estate plan lawyers engage in discussions with clients about who to appoint as successor trustees for revocable living trusts. Just as frequently, those clients often want to designate their children, siblings or other family members to take…

Can you identify your digital assets? Could someone else in your place? Have you considered your digital legacy? By definition, digitial assets include digitally stored content and online accounts owned by an individual. Within just a few years, the value and importance of digital assets have soared. Why are digital assets important? Financial Value – Think Paypal/Venmo/Square…

Happy Earth Day! Environmentally-friendly burials are gaining in popularity and becoming a viable option without interfering with traditions. Our office getting more and more inquiries about options and planning.

Greetings friends, clients, and colleagues! We are making an attempt to re-start our “monthly” newsletter. (We’ve been blessed with an ample of amount of growth and work this year which we thank you for!)

So what happens when a spouse passes away with the former sub-trust estate plans from 20+ years ago? The trust administrator endures headaches and could spend a lot of time on unnecessary sub-trust allocations or administration complications.

Many parts of life planning require a discussion of uncomfortable topics. Drafting your advance health care directive is no exception. No one likes to talk about “end of life” preferences. However, having an advance health care directive can ensure that your preferences are carried out when you are unable to make your own health care decisions. An Advance Health Care Directive is a legal document outlining your health care choices.

In many cases, when senior citizens need help in managing their money, adult children or other relative step in, but oftentimes, the children live too far away or just don’t have the time due to their own busy schedules. Whether it’s just balancing a checkbook or a monthly reminder of bills that are due, the process of elder preparedness should include money management services.

To get a better grasp of the trust administration process, it is important to have at least a basic understanding of what a trust is and how it can function in the estate planning process. A trust is a legal mechanism frequently used in estate planning, not only to manage property assets during a person’s lifetime, but also to distribute assets after death. A trust can distribute estate assets to several different people or entities and also set conditions as to when and how much each beneficiary will receive.

Care for the elderly can be quite stressful and at times completely overwhelming. A caregiver or potential caregiver can avoid a considerable amount of elder care stress by taking a proactive approach in organizing and planning for the unplanned events in life. It is very important to get all paperwork and legal papers in order while the aging person in your life is still well, if at all possible.

We all want to ensure that our loved ones remain safe, happy and secure as they age, and there are some easy, practical ways to help them do so. If your senior lives in their own home, a few things that may be beneficial to senior’s physical safety include:

A trust can be a valuable tool in your estate planning in the right circumstances, and is critical to carrying out your wishes when you pass away. Trusts can give you the ability to immediately transfer assets and provide for beneficiaries without the need for probate. A trust sets up a legal relationship in which property or assets of the grantor are held by the trustee for the benefit of the beneficiary.

If you have parents or grandparents who are in their declining years, you may begin to feel overwhelmed by the magnitude of changes that are taking place in their lives. It is truly a time of entering the unknown, because none of you has likely experienced this before in the roles you now occupy. Their independence begins slipping away as simple tasks—shopping, driving, preparing meals—suddenly become unmanageable because of increasing forgetfulness or a broken hip from a fall.

A fiduciary is a person given the responsibility of caring for your finances when you are unable to do so. Many times people choose a trusted friend or family member to care for their financial assets. Why use a professional fiduciary instead? Consider our top three reasons.

Dementia is a general term for loss of memory and other mental abilities. It has always been a common affliction among the elderly, but has become more and more prevalent in recent years. Awareness, acceptance, early treatment and intervention are crucial to help slow and manage the effects of this potentially devastating problem.

It is essential that a trustee exercise an extreme amount of caution when dealing with the trust and its assets. The personal duties of a trustee start with the most important: never, ever, under any circumstances commingle estate funds with the trustee’s personal funds. This is an essential component of the duty to avoid a conflict of interest. A trustee must be aware of and avoid any situation that creates a conflict of interest with the terms of the trust and the duties of the trustee.

I developed the idea of a communications notebook when I was caring for my grandmother which became a valuable tool that helped me stay on top of her day-to-day care while ensuring she maintained a high quality of life. Visitors are a very important aspect of ensuring the elder in your care has enough social stimulation, but there may also be times when you need to curtail a situation where there is too much activity.

The duty of loyalty includes the duty to deal impartially with all beneficiaries. This can be especially challenging if there are many beneficiaries each with different wants and needs. It is further complicated when the trustee is also a beneficiary. Above all, the terms of the trust dictate how the trustee must proceed with regard to the beneficiaries. When the trust documents are not explicit the trustee must use their best judgment to perform his job.

When I was taking care of my grandmother I developed a communications notebook as a tool to help her day-to-day caretakers and myself manage her quality of life. In the past two newsletters I covered the overall purpose of the communications notebook and the Weekly Activity Schedule included in Tab 1. This month I will address the second tab, which includes the Daily Meal Schedule.

The beneficiaries of the trust are those who enjoy the benefit of a trust’s assets. Beneficiaries may include the spouse, children, associates or other family members of the creator of the trust. Non-profit organizations, religious institutions and other charitable entities as well as businesses may also be beneficiaries. The Trustee has certain duties to all the beneficiaries of the trust, which may become more complicated when there are different classes of beneficiaries or when the trustee is also a beneficiary. One very important duty is the duty of loyalty to the trust’s beneficiaries.

The Daily Schedule tab of the Communications Notebook is an excellent way to ensure the elder in your care continues to lead a full life that she enjoys. It helps caregivers understand what activities are important and ensures that they have a full range of ideas for what to do each day. You can keep a close eye on how your elder is doing each day too.

Lindsay Leonard of Santa Barbara Estate Services became a licensed California Professional Fiduciary this year and earned certifications in Professional Fiduciary Management for Conservators and for Trustees. She also became a National Certified Guardian and joined the Professional Fiduciary Association of California. These credentials will allow her to enhance the scope of services offered to existing clients and expand her practice to a wider audience.

This is the third article in a series detailing the duties of a trustee. We have explored the duty of a trustee to comply with the terms of the trust instruments as well as the duties to control trust property and make it productive. This time I will address the duty to enforce claims the trust has against others and to defend actions against the trust. Before taking on the responsibility of acting as a trustee it is crucially important that you fully understand all the legal duties that come with the job.

Last newsletter I covered the duty of a trustee to comply with the terms of the trust instruments. This time I will address the duty to control the trust property as well as make the property productive. This means that the trustee has a legal obligation to ensure that the trust not only maintains value but also increases in value as appropriate within the terms set out by the trust instruments.

Estate planning does not begin and end with drawing up a will or trust. It encompasses the entire process of communicating to your loved ones how you would like to leave your affairs. Unfortunately, it is all too common for a family to become bitterly divided after a death. Survivors file lawsuits and engage in nasty behavior rather than celebrate the life of the deceased. Proper communication during the estate planning process can help avoid these problems. However, because this can be an emotional time people are often reluctant to have these conversations.

When working with elderly clients who are trying to get their affairs in order, performing an inventory of their financial and personal assets is an excellent place to start. Not only does it decrease the burden on their loved ones, but it helps elders feel in control of their affairs. There is an added bonus that in an emergency this helps establish and expedite insurance claims.

Trustees have a variety of critical duties. Failure to fully carry out these duties can result in legal liability for the trustee. Trustee duties fall into three general categories: to the trust itself, to the beneficiaries, and personal duties. Today I’ll address some of the duties a Trustee has towards the Trust itself.

Most people have two major goals in estate planning. The first is ensuring that their wishes are honored, both during their lifetime, and after. The second is reducing administrative costs. Choosing the wrong fiduciary can mean that these goals are not met. Your appointment for power of attorney and trustee means selecting the person who will control, manage and distribute assets when you are incapacitated or deceased, which makes it crucial to carefully think out this appointment. By the end of this article you will understand the importance of making the right appointment and how to go about doing so.

Lindsay Leonard said taking care of her grandmother before she passed away was like getting “a crash course in eldercare.” The aftermath was equally revealing. As it turned out, it was a useful education that prepared her well for the business she recently launched — Santa Barbara Estate Services.

Estate trustees and executors frequently find that administering an estate after the passing of a loved one is overwhelming and requires enormous time and effort. Santa Barbara Estate Services has just launched a service to help these trustees in settling an estate.